As we stand at the threshold of 2026, the landscape of China’s electric two-wheeler (E2W) exports—comprising e-bikes, e-scooters, and e-motorcycles—has shifted from a simple “volume game” to a high-stakes “tech and policy game.” For investors and merchants, understanding the divergence in global markets and the battery revolution is no longer optional; it is the key to survival.

1. Global Market Hierarchy: Where the Money is in 2025

In 2025, China’s domestic market reached a saturation plateau (approx. 50 million units annually), making international expansion the primary growth engine for giants like Ninebot (Segway), Yadea, and Aima.

Regional Importance Ranking:

| Rank | Region | Market Characteristics | Key Drivers |

| 1 | Southeast Asia | High-growth hub (Indonesia, Vietnam). | Massive subsidies and fuel-to-electric transition. |

| 2 | Europe | Premium high-margin market. | Green Deal policies and E-bike culture. |

| 3 | North America | High-barrier but stable demand. | Commuter and recreational E-bike popularity. |

| 4 | LatAm & MEA | Emerging delivery logistics. | “Last-mile” delivery and urban congestion. |

Image 1: The Global Overview

2. The 2026 Policy Pivot: Navigating Trade Barriers

The “Golden Era” of frictionless exports is ending. 2026 will be defined by “Localization or Taxation.”

- USA: The Battery Tariff Wall: Starting in 2026, tariffs on non-EV lithium-ion batteries from China are set to jump from 7.5% to 25%. Direct exports of battery-equipped bikes will face immense price pressure.

- EU: CBAM & De Minimis Changes: The Carbon Border Adjustment Mechanism (CBAM) ends its transition phase. Exporters must now report carbon footprints, particularly for aluminum frames. Additionally, the removal of the 150-euro tax exemption for e-commerce parcels will squeeze cross-border margins.

- ASEAN: Local Content (TKDN): Indonesia and Thailand are tightening “Local Content” requirements. To qualify for subsidies in 2026, over 60% of components must be sourced or assembled locally.

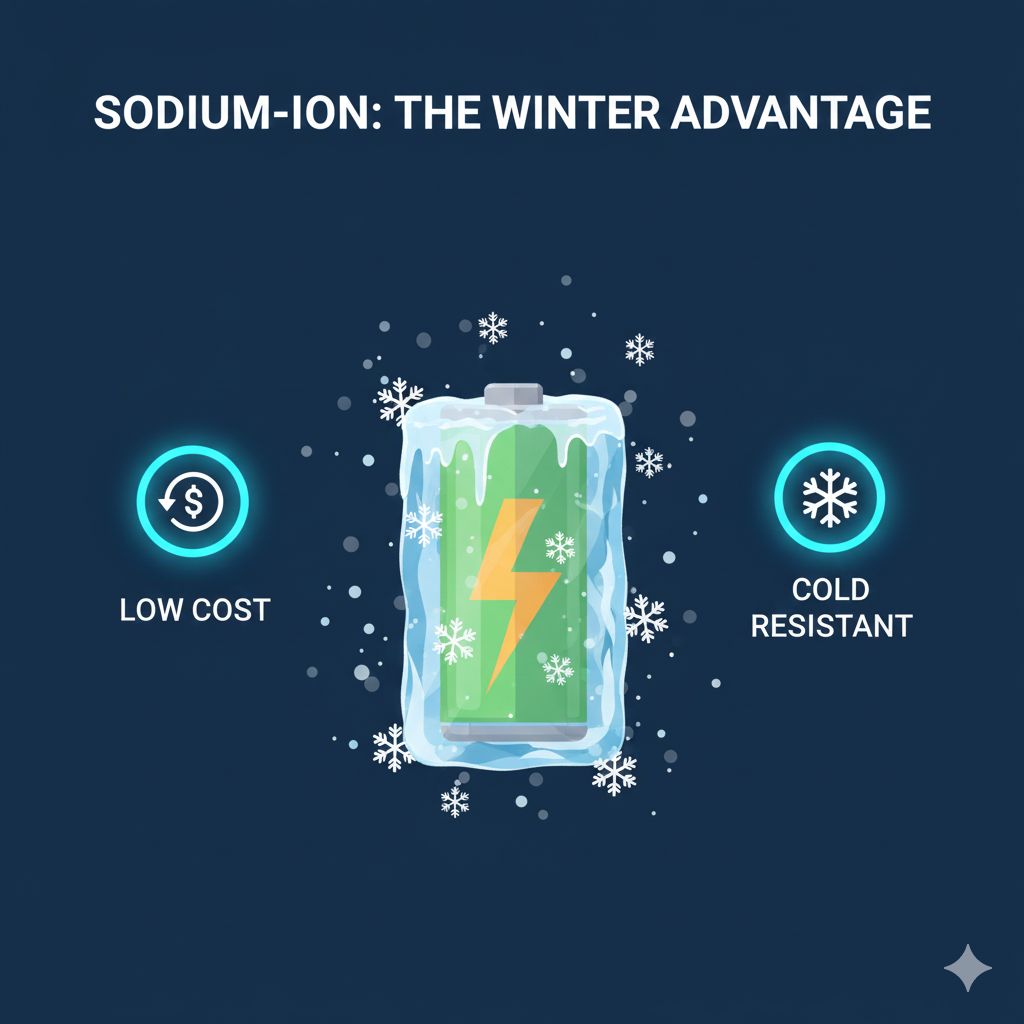

3. The Tech Battle: Sodium-Ion vs. Lithium-Ion

The most significant shift in 2026 is the commercialization of Sodium-ion (Na-ion) batteries as a strategic alternative to Lithium (LFP/NCM).

Why Sodium-Ion is the “Wild Card” for 2026:

- Cost: 30-40% cheaper raw materials than lithium.

- Winter Performance: While lithium fails in the cold, Sodium-ion maintains >90% capacity at -20°C—perfect for the Northern US, Canada, and Northern Europe.

- Safety: Higher thermal stability reduces shipping fire risks and compliance costs.

The Future Connection: Watch for Solid-State technology. While full solid-state lithium batteries are still premium, 2026 marks the rise of Semi-Solid State batteries in high-end electric motorcycles, offering double the range of current models.

4. Case Study: Ninebot (Segway) 2026 Strategy

As a market leader, Ninebot’s 2026 roadmap serves as a blueprint for the industry.

- Battery Suppliers: Ninebot currently relies on Samsung SDI (for premium US/EU models) and EVE Energy (strategic global partner).

- The 2026 Shift: Expect Ninebot to launch a dedicated Sodium-ion series for the 2026 export market. This move bypasses lithium tariffs and targets all-weather performance.

- Software Integration: Their new Nimble OS and Smart-BMS 6.0 will focus on “Efficiency through Intelligence,” squeezing 20% more range out of the same battery capacity via AI algorithms.

5. Investor’s Watchlist: Key A-Share Stocks

For those looking to capitalize on the supply chain, these are the “Top Picks” in the Chinese A-share market:

- The Giants: CATL (300750) and BYD (002594). Both are leading the charge in sodium-ion and semi-solid state mass production.

- The Sodium Specialists: Huayang Group (600348) and Transimage (002861). These companies have the most mature sodium-ion production lines.

- The Core Materials: Dufluoride (002407). A key supplier of sodium electrolytes—their pricing is the leading indicator for the entire sodium battery sector.

- The Equipment Leader: Lead Intelligent (300450). They provide the machinery for both solid-state and sodium battery factories.

Conclusion

The 2026 export market belongs to the adaptable. Success will depend on moving assembly closer to the end consumer (CKD/SKD in SE Asia or Mexico) and embracing new battery chemistries like Sodium-ion to stay price-competitive under new tariff regimes.