With the rapid development of financial technology, Crypto, as an emerging asset class, has gradually moved from the fringe to the mainstream. Recently, the Hong Kong Stock Exchange approved the listing of the first Cryptocurrency ETF, which undoubtedly brings new vitality and opportunities to the Crypto market. In this blog post, we will explore the possible impact of this event on the Crypto market.

Introduction to Crypto ETFs

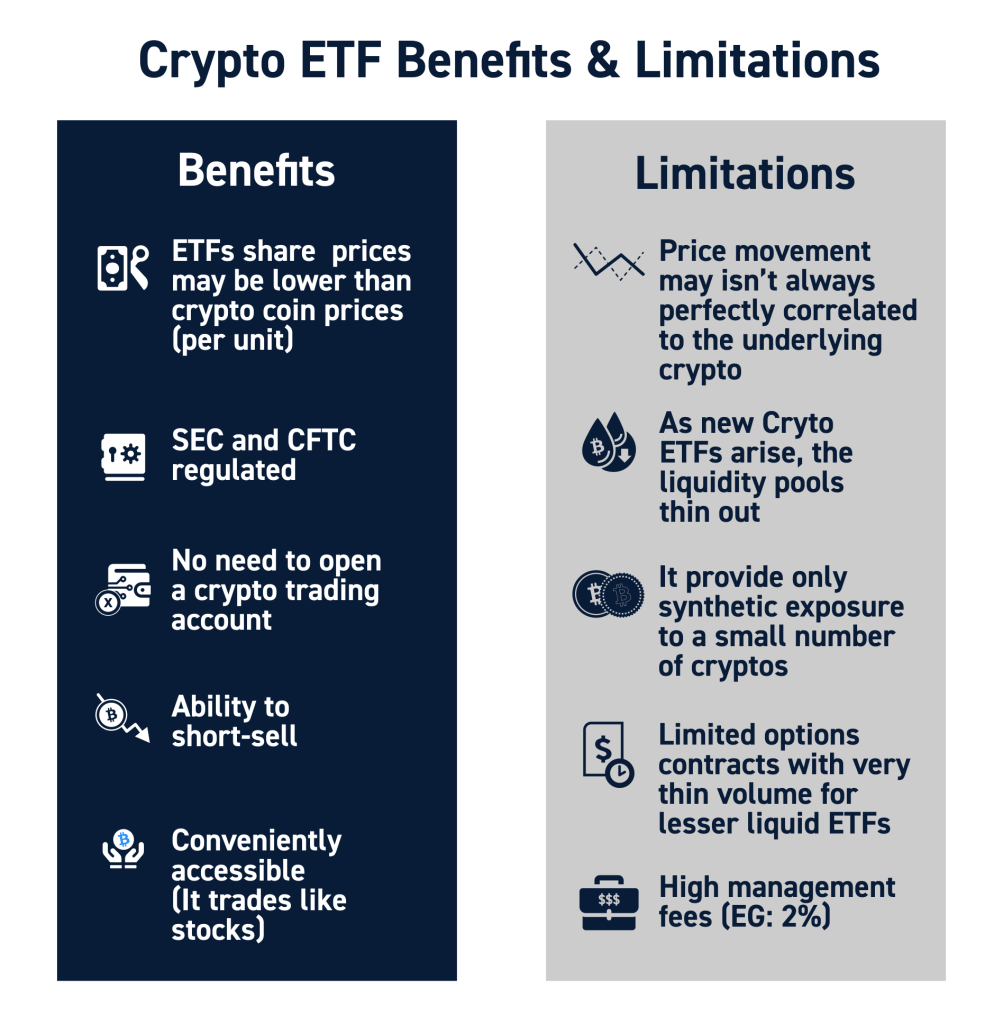

An ETF, or Exchange-Traded Fund, is an open-ended index fund that can be traded on a stock exchange. Unlike traditional funds, ETFs offer higher liquidity and flexibility, allowing investors to buy and sell ETFs at any time during the trading day, just like stocks.

Features of Crypto ETF Listing in Hong Kong

- High Transparency: ETF’s positions and prices are updated in real time, so investors can have a clear picture of its investment status.

- Diversification: ETFs usually contain multiple assets and diversification can reduce the risk of a single asset.

- Low threshold: Compared with buying virtual currencies directly, ETFs offer a lower investment threshold.

Based on the first batch, here is a list of relevant ETFs:

- Huaxia Bitcoin ETF (03042.HK)

- Huaxia Ethereum ETF (03046.HK)

- Bosera Bitcoin ETF (03008.HK)

- Bosera Ether ETF (03009.HK)

- Harvest Bitcoin ETF (03439.HK)

- Harvest Ether ETF (03179.HK)

These ETF products allow redemptions in either cash (in-cash) or physical (in-kind) and are listed and traded on the Hong Kong Stock Exchange.

Impact on the Crypto market

- Increase liquidity

The listing of Crypto ETFs will bring more liquidity to the market. Investors can easily access the virtual currency market by purchasing ETFs without having to buy and store Cryptos directly. - Increase Market Recognition

The listing of ETFs is a recognition of the legitimacy and maturity of the Crypto market. This may attract more institutional and retail investors, further boosting the market. - Price volatility

While ETFs can bring stability to the market, they may increase the price volatility of Cryptos in the short term, as new investors entering the market may have a short-term impact on the market. - Regulatory challenges

The listing of Crypto ETFs may raise concerns at the regulatory level. Regulators need to ensure the fairness and transparency of the market while protecting the interests of investors. - Technological innovation

The launch of ETFs may stimulate more fintech innovations, including innovations in trading tools and investment strategies.

The listing of Crypto ETFs in Hong Kong is a landmark event, which not only provides investors with a new investment channel, but may also have a far-reaching impact on the Crypto market as a whole. However, this development also brings new challenges, including market regulation and investor education. As the market continues to mature, it is reasonable to expect Cryptos to play a more important role in the financial market in the future.