Up until now, earning money from video games has been one-sided. Players have always wanted to be rewarded for their time playing by being given an advantage or power within the game itself. However, with the current shift in gaming psychology, players want more control over how they are portrayed and compensated for their participation.

Rephrase GameFi is a portmanteau of gaming and finance. It refers to the growing trend of incorporating financial incentives into video games, which is often referred to as “play-to-earn” (P2E). This business model relies on blockchain technology, which allows players to acquire tokens in exchange for their participation. In addition, it introduces concepts such as player ownership instead of traditional consumerism.

What GameFi stand for?

The term “GameFi” was coined in 2020 by Andre Cronje, the CEO of Yearn Finance. It is a combination of blockchain technology, non-fungible tokens (NFTs), and game mechanics to create an immersive virtual environment where players may participate and earn tokens.

Until recently, video video games have been housed on centralized servers, giving builders and publishers the rights to the whole lot inside their games. This intended that gamers had no proper possession or manipulation over any of the digital objects amassed over hours — or years — of gameplay. These gadgets vary from weapons and costumes (also recognized as ‘skins’) to avatars and digital lands — very few of which had any price backyard of the game. As such, there used to be no actual way for gamers to get compensated for their time spent online or share in the cost of their earned in-game belongings besides following the route of professionalism (such as vlogging, Twitch streaming, or taking part in competitively in tournaments).

This is now not the case with GameFi projects, however. Players of these video games can reap in-game rewards through finishing duties and progressing thru several sports levels. Unlike ordinary in-game currencies and items, these rewards have measurable costs outdoor of the gaming ecosystem.

For example, sports objects awarded in the structure of an NFT or tokens for achievements can be traded on NFT marketplaces and crypto exchanges; hence, incomes the area the ‘play-to-earn’ moniker.

It’s vital to be aware that ‘play-to-earn’ is the famous nomenclature, however enjoying in GameFi doesn’t come besides risk, along with probably excessive preliminary prices that a participant would possibly lose or fail to recoup.

How Does GameFi Work?

Almost all blockchain-based video games are accompanied by using a corresponding in-game currency, marketplace, and token economy. Unlike regular gaming, there is no centralized authority in control. Instead, GameFi initiatives are normally managed and ruled by way of the community, with gamers even capable to take part in decision-making. While the mechanics and economics of personal GameFi initiatives may additionally differ, there are a few commonalities:

- Blockchain Technology: GameFi initiatives run on a blockchain’s dispensed ledger. This continues the song of participant possession whilst making sure that all transactions are transparent.

- Play-to-Earn Business Model: In distinction to common gaming, the place customers play to win, GameFi initiatives undertake a P2E model. These video games incentivize gamers to play and grow inside the recreation by way of supplying rewards that have measurable price backyard of the game. These commonly come in the structure of in-game cryptocurrencies or NFTs.

- Asset Ownership: In regular gaming, in-game purchases are non-transferable investments locked inside a single game. With P2E, gamers personalize their in-game tokenized assets. In most examples, they can change them for cryptocurrencies and, ultimately, fiat. Assets can vary from a go well with of armor to a plot of digital land, which is tokenized on the blockchain.

- DeFi Solutions: Many GameFi tasks may additionally encompass decentralized finance (DeFi) elements, such as yield farming, liquidity mining, and staking. These furnish additional avenues for gamers to make bigger their token assets.

Play-to-Earn (P2E) and the Advent of GameFi

In 2017, Ethereum launched CryptoKitties, the first broadly known blockchain game. Shortly after, a range of different decentralized blockchain video games have been launched, consisting of Ether Shrimp Farm, Ether Cartel, and Pepe Farm. These video games use a P2E monetary model, which presents gamers with the possibility to monetize their time spent taking part in games.

However, it wasn’t till the international pandemic in 2020 that the P2E mannequin sincerely took off. With many homebound due to lockdown restrictions, P2E video games supplied token-generating possibilities for the common person.

As stated earlier, earlier than P2E, the economics in video games usually flowed from the participant to the publisher. With the P2E model, however, gamers are compensated for their efforts and time spent online with digital belongings that have a free backyard of recreation and which may also respect over time. Because these properties are saved on a blockchain, they are owned by way of the players, no longer the sport developer. It’s vital to be aware that the fee for digital belongings is unstable and might also additionally depreciate over time.

In P2E games, in-game properties are normally represented as NFTs, which gamers can gain thru in-game development and gameplay (such as taking phases in precise tasks, challenges, duels, and competitions). The gain of these NFTs is that they can be exchanged for cryptocurrencies that can then be traded for fiat on third-party exchanges, spearheading an entirely new world of digital economies. Examples of popular P2E video games consist of Axie Infinity, The Sandbox, and Decentraland.

Source: The Sandbox

Unlike usual video games, the place builders manage all in-game economics, gamers in P2E video games have possession and manipulate over their digital assets. They can even contribute to sports choices and assist structure of the future of the sport via the accumulation of tokens.

Take Axie Infinity, for example, an Ethereum-based recreation that rose to prominence in 2021 and grew to become the world’s most Googled NFT in March 2022. In Axie Infinity, gamers collect, breed, train, and conflict creatures referred to as ‘Axies’. Unlike traditional in-game items, every Axie can be traded on the game’s market for actual cash (for context, the most steeply-priced Axie ever bought was once for US$820,000).

The sport has two native cryptocurrencies: Axie Infinity Shards (AXS), which can be sold and bought on exchanges like Crypto.com, and Smooth Love Potion (SLP), which is what gamers earn via enjoying the game. AXS is additionally used as a governance token, permitting token holders to vote on the future improvement of the gaming experience.

With all that said, video games like Axie Infinity can have an excessive value of entry. To begin playing, customers need to purchase three pet characters. Previously, constructing a common crew would have a value of around US$300, however, costs have given cooled with the aid of about a third.

Despite the price drop, this preliminary fee is nevertheless a large barrier for many, in particular as the sizeable majority of blockchain recreation gamers presently hail from creating countries. This hurdle has led to the upward push of gaming guilds — systems that allow NFT proprietors to lend out in-game belongings (NFTs) in return for a share of the property generated — which limit the tremendous upfront expenses for would-be participants. The most accepted guild is Yield Guild Games (YGG).

Source: Axie Infinity

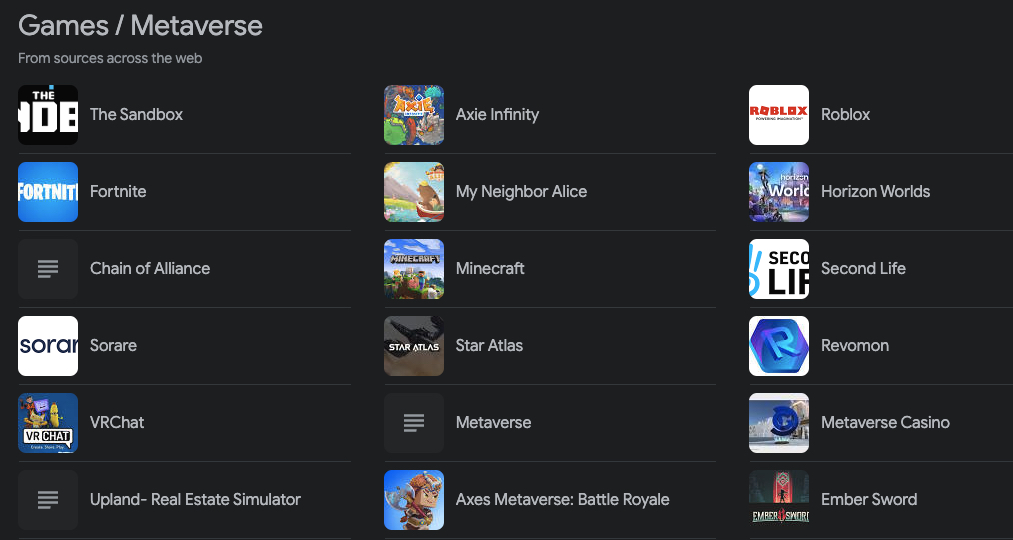

Popular Play-To-Earn Games

1. Axie Infinity

Axie Infinity is an NFT-based online video game developed by the Vietnamese studio Sky Mavis. On it, players can collect, breed, raise, battle, and even trade token-based creatures, known as ‘Axies’. At its peak in November 2021, the company reportedly had 2.7 million active daily users.

2. Decentraland

Created by Ariel Meilich and Esteban Ordano, Decentraland is a virtual world that runs on Ethereum. In it, players can buy virtual plots of land as NFTs using the MANA cryptocurrency. They can then buy and sell the land they own, or rent out such assets to other players on the platform.

3. The Sandbox

The Sandbox is a virtual metaverse where players can play, build, own assets, and put their virtual experiences to use. It provides its users with the tools to create their very own 3D games and experiences, which they can then share, rent out, or sell in exchange for tokens. The Sandbox uses several different tokens to ensure a circular economy between the four types of users on the platform: players, creators, curators, and land owners. These tokens include SAND, the utility token used throughout The Sandbox ecosystem; LAND, a digital piece of real estate in The Sandbox metaverse; and ASSETS, a token created by players who build user-generated content (UGC).

4. Game of Silks

Silks leverage a blockchain-enabled metaverse to create a digital parallel of the real world of thoroughbred horse racing. Each digital Silks Horse NFT is a derivative of a real-world racehorse, meaning that every time the racehorse wins a race or breeds offspring in the real world, the owner of its corresponding Silks Horse will earn tokens (STT). In addition to Silks’ Horse NFTs, users of the platform can own, trade, and interact with Silks Avatars, Land, Stables, and a wide variety of other in-game NFTs. They can also earn rewards through its unique staking mechanism.

5. CryptoBlades

Launched on the BNB Chain and developed by Riveted Games, CryptoBlades is a P2E web-based RPG (role-playing game) that rewards players with SKILL tokens after defeating enemies and participating in raids. Players can trade their characters and weapons in an open marketplace or bet their SKILL token earnings to receive additional tokens as a reward.

Blockchain games were responsible for half of all blockchain usage in 2021. As of February 2022, the GameFi market cap has climbed to US$55.38 billion.

Start With GameFi

1. Create a Crypto Wallet

To make in-game transactions and store the virtual currencies and NFTs collected during gameplay, you will need a crypto wallet. There are many different wallets available, like the Crypto.com DeFi Wallet, but most games demand the use of specific wallets. Be sure to visit the game’s official website to see which wallets it supports.

2. Connect the Wallet With the Game

Unlike traditional games that require a username and password, blockchain games use your crypto wallet as your account. To avoid scams, only use wallets downloaded from official app stores that are explicitly linked to the wallet’s official website. Further, as an additional security precaution, it’s recommended that you use a different wallet for each game you play.

3. Add Funds to Your Wallet

You will need to pre-fund your crypto wallet with a compatible cryptocurrency to purchase any starter items (i.e., characters or native crypto tokens) required to play the game.

You may also be interested in: What is a Crypto Wallet? A Beginner’s Guide

The Future of GameFi

With an estimated 3.24 billion game enthusiasts throughout the globe, there is a big chance for an increase in the rising GameFi sector. In 2021 alone, buyers poured over US$3.6 billion into crypto gaming startups, making 2021 a landmark 12 months for the burgeoning industry.

Source: gamefi.org

For many enterprise commentators, gaming represents the most probable route to sizeable blockchain adoption. This is an opinion supported by way of a DappRadar x BGA Games report, which discovered that blockchain video games attracted 1.22 million special lively wallets (UAW) in March 2022.

With that said, there is resistance to blockchain-based video games from the gaming neighborhood — especially when it comes to sports mechanics and NFTs.

Many GameFi fanatics chalk this instead terrible outlook down to a gross misunderstanding of blockchain science and how it works. As with crypto in general, one of the largest roadblocks to mass adoption is a lack of understanding. To tackle this and assuage any concerns, builders must make investments in time and electricity into enhancing now not solely the gaming mechanics, but the public appreciation and standpoint of blockchain science and GameFi.

According to a current lookup record using Crypto.com, Naavik, and BITKRAFT Ventures, it is estimated that the blockchain gaming market will develop at a compound annual increase fee (CAGR) of 100%, from US$1.5 billion in 2021 to US$50 billion in 2025. This is 20 instances of the forecasted ~10% CAGR for the regular gaming industry. If blockchain video games can supply game enthusiasts with equal fees (or fun) as usual video games — with the introduced workable for revenue — then there certainly is no restriction to GameFi’s potential.

Wherever you stand on the theme of GameFi, there are no two approaches to it — it used to be one of the most up-to-date crypto sectors that got here out of 2021. It is one to preserve an eye on.

Due Diligence and Do Your Research

All examples listed in this article are for informational purposes only. You must now not construe any such facts or different fabric as legal, tax, investment, financial, or different advice. Nothing contained herein shall represent a solicitation, recommendation, endorsement, or provide by using Crypto.com to invest, buy, or promote any NFTs or crypto assets. Returns on the shopping for and promoting of crypto property may additionally be a tax concern, together with capital-positive aspects tax, in your jurisdiction.

The period ‘play-to-earn’ refers to the widespread idea in a gaming platform affords a participant with rewards, such as in-game tokenized assets. Participating in a play-to-earn product does now not assure effective returns. Play-to-earn merchandise no longer comes except risk, and individuals can incur excessive preliminary costs, which might also be partly or unrecoverable.

Past overall performance is no longer a warranty or predictor of future performance. The fee of crypto property can make bigger or decrease, and you should lose all or a considerable quantity of your buy price. When assessing a crypto asset, it’s fundamental for you to do your lookup and due diligence to make the first-class feasible judgment, as any purchases shall be your sole responsibility.

I am no longer sure where you’re getting your information, however good topic. I must spend some time studying much more or working out more. Thanks for fantastic information I used to be on the lookout for this information for my mission.

You are my breathing in, I possess few blogs and often run out from to brand.

I conceive this web site holds some very superb info for everyone. “The penalty of success is to be bored by the attentions of people who formerly snubbed you.” by Mary Wilson Little.

I have been absent for some time, but now I remember why I used to love this site. Thank you, I will try and check back more frequently. How frequently you update your web site?